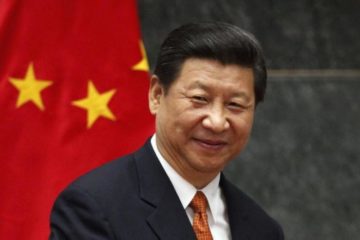

The global renewable energy market has been growing, but there are concerns about policy-related headwinds. Since 2017, the United States government has attempted to reverse a number of existing energy policies which were designed to fight climate change by reducing greenhouse gas emissions. The overall focus has been the deregulation of the oil and gas industry. The US has also increased tariffs on Chinese solar panels and announced plans to exit the Paris Climate Agreement. Generally speaking, the current U.S. government has been implementing policies designed to benefit the coal, oil and gas sectors, with a focus on job creation. So what does this mean for the renewable energy sector? Fortunately, not much. It’s neither good nor bad news.

The future of the American solar market looks very bright, irrespective of current US energy policy. As the cost of solar panels and related equipment continue to decline, solar energy is beginning to compete head-to-head with traditional forms of electric power generation, such as coal and natural gas power plants.

The future of energy is renewable. As costs of solar and wind decline further, we will see a continued shift away from fossil fuels. The expansion of the electric vehicle market will also be a key catalyst of this transformative process. Note that as electric vehicle costs decline and manufacturers shift away from producing combustion engines, the demand for more electricity derived from renewable energy resources such as wind and solar, will expand materially.

Emerging markets, which constitute most of the demand growth for electricity, may adopt electric vehicles at a more rapid pace than most analysts have been predicting. The main reason for this is the quick decrease in electric car prices and a massive investment by the global auto industry to produce new, more affordable electric vehicles. This may allow emerging markets to transition to electric vehicles more quickly than previously thought. This process would be synergistic with the expansion of renewable energy in these markets.

The common misunderstanding many people have about investment in the renewable energy market is based on the fact that the market is dynamic and changing very quickly, driven exceedingly by market forces than government policies. The continued decline in renewable energy costs will further insulate the market from the impact of government policy headwinds. As solar power has become cheaper (on an LCOE basis) than coal and gas power in many markets, expect to see increasing investment in the renewable energy sector – both in the United States and globally.